Exploring the Advancements and Potential of Blockchain Technology

-

10/04/2023

-

864

-

0

Blockchain technology is transforming the financial industry, offering a decentralized and secure way of conducting transactions. In this article, we explore its advancements and potential.

Related posts

A Comprehensive Guide to App Store Marketing Strategies

Boost Your App's Success with These Top ASO Tools And Techniques

1. The basics of blockchain technology

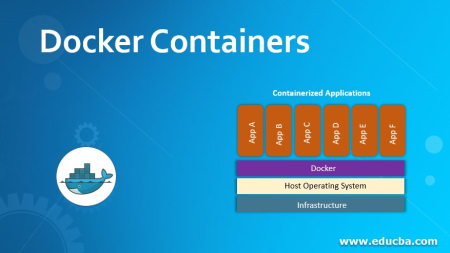

Blockchain technology is a digital ledger system that records transactions in a decentralized and secure way. It is composed of blocks of data that are linked together in a chronological chain using cryptographic algorithms; creating an immutable record that cannot be altered or deleted.

The benefits of blockchain technology in finance include increased transparency; lower costs, and faster processing times. Blockchain can also reduce the risk of fraud and provide a more secure way of storing and sharing sensitive financial data.

Examples of blockchain in finance include cryptocurrencies such as Bitcoin and Ethereum, as well as applications for trade finance; cross-border payments, and supply chain management. Overall, the basics of blockchain technology make it an attractive option for financial institutions looking to improve their systems and processes.

2. The future of finance with blockchain technology

The future of finance with blockchain is promising as advancements in this technology continue to disrupt traditional finance systems. Blockchain technology has the potential to improve the efficiency; security, and transparency of financial transactions, leading to a more decentralized and equitable financial landscape.

Advancements in blockchain for finance include the development of smart contracts, decentralized applications (DApps); and the interoperability of different blockchain networks. These advancements are expected to enable faster and more cost-effective transactions; as well as more secure and transparent record-keeping.

The future of finance with blockchain technology, Source: Asoservice.com

The impact of blockchain technology on traditional finance systems will likely be significant; as it reduces the need for intermediaries such as banks and payment processors. This can result in lower transaction fees and faster processing times; making financial services more accessible to individuals and businesses around the world.

Moreover, blockchain technology has the potential to disrupt the financial industry by creating new business models and revenue streams. For example, decentralized finance (DeFi) platforms that use blockchain technology to provide financial services; such as lending, borrowing, and trading; without intermediaries or central authorities are gaining traction and attracting significant investment.

In summary, the future of finance with blockchain technology is bright as advancements continue to be made; paving the way for more efficient, transparent, and equitable financial systems.

3. Decentralized finance (DeFi) with blockchain

Decentralized finance (DeFi) is a financial system that uses blockchain technology to offer financial services without intermediaries such as banks and payment processors. DeFi is built on open-source software that allows anyone to access, use, and develop financial applications on a decentralized network.

Blockchain technology enables DeFi by providing a secure and transparent way of conducting transactions, as well as a way to program and automate financial agreements using smart contracts. Smart contracts are self-executing agreements that are stored on the blockchain and automatically enforce the terms of an agreement when certain conditions are met.

DeFi applications include decentralized exchanges (DEXs), which allow users to trade cryptocurrencies without a central authority, and lending platforms that enable users to borrow and lend cryptocurrencies using smart contracts. Other DeFi applications include prediction markets, insurance platforms, and stablecoins. This can help developers create monetization strategies; aligned with user expectations and needs. Or you can buy Google reviews to increase you app ranking on App Store.

Overall, DeFi, with blockchain technology, has the potential to disrupt traditional financial systems by offering greater accessibility; transparency, and control over financial services. However, there are also challenges to be addressed, such as the need for scalability; security, and regulatory compliance in a decentralized environment.

4. Security and privacy with blockchain

While blockchain technology has the potential to transform the finance industry, it also presents several challenges and limitations that must be addressed for wider adoption and use. Here are some of the key challenges and limitations of blockchain technology in finance:

Scalability: As blockchain technology grows, the size of the blockchain can become unwieldy, leading to slow transaction times and high fees. This makes it challenging to scale blockchain technology to handle the volume of transactions required in the finance industry.

Interoperability: There are currently multiple blockchain platforms, and they often use different standards, making it difficult to transfer data or value between them. This lack of interoperability is a significant hurdle for the broader adoption of blockchain in the finance industry.

Regulatory compliance: The finance industry is highly regulated, and blockchain technology presents unique regulatory challenges, such as determining which entities are responsible for compliance and how to ensure compliance in a decentralized environment.

Security: While blockchain technology is generally secure, it is not immune to hacking or other security threats. Furthermore, while a decentralized network can be more secure, it can also present new security challenges; such as the risk of 51% attacks.

Adoption and education: Blockchain technology is still relatively new, and many people in the finance industry may not fully understand how it works or the potential benefits it can provide. The widespread adoption of blockchain technology will require significant education and investment.

Environmental impact: Some blockchain networks use a proof-of-work consensus mechanism that requires significant energy consumption, leading to environmental concerns.

While blockchain technology has the potential to revolutionize the finance industry, it is important to recognize and address these challenges and limitations to fully realize its potential. Addressing these challenges will require collaboration between industry leaders, regulators, and technology providers to create a more efficient, secure, and accessible financial system.

5. Challenges and limitations of blockchain in finance

While blockchain technology has the potential to transform the finance industry, it also presents several challenges and limitations that must be addressed for wider adoption and use. Here are some of the key challenges and limitations of blockchain technology in finance:

Scalability: As blockchain technology grows, the size of the blockchain can become unwieldy, leading to slow transaction times and high fees. This makes it challenging to scale blockchain technology to handle the volume of transactions required in the finance industry.

Interoperability: There are currently multiple blockchain platforms, and they often use different standards, making it difficult to transfer data or value between them. This lack of interoperability is a significant hurdle for the broader adoption of blockchain in the finance industry.

Regulatory compliance: The finance industry is highly regulated, and blockchain technology presents unique regulatory challenges, such as determining which entities are responsible for compliance and how to ensure compliance in a decentralized environment.

Adoption and education: Blockchain technology is still relatively new, and many people in the finance industry may not fully understand how it works or the potential benefits it can provide. The widespread adoption of blockchain technology will require significant education and investment.

While blockchain technology has the potential to revolutionize the finance industry, it is important to recognize and address these challenges and limitations to fully realize its potential. We will discuss why user reviews and ratings are important and offer some strategies for get app ratings from users to leave reviews and ratings for your app. Addressing these challenges will require collaboration between industry leaders, regulators, and technology providers to create a more efficient, secure, and accessible financial system.

6. The future outlook for blockchain technology in finance

The future outlook for blockchain in finance is promising, with the potential to transform the industry in many ways. Here are some of the key areas where blockchain technology is expected to have a significant impact in the finance industry:

Payment processing: Blockchain has the potential to streamline payment processing, reducing the time and costs associated with traditional payment methods. It also provides increased security and transparency, making it an attractive option for businesses and consumers.

Smart contracts: Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. Blockchain technology provides a secure and transparent platform for smart contract execution; enabling automated and trustless financial agreements.

Supply chain management: Blockchain can improve supply chain management by providing transparency and traceability. It allows companies to track the movement of goods from production to delivery; reducing fraud and increasing efficiency.

Cross-border payments: Blockchain technology can facilitate cross-border payments by removing intermediaries and providing a secure; and efficient platform for international transactions.

Overall, the future outlook for blockchain in finance is bright. While there are challenges and limitations to be addressed, blockchain has the potential to provide increased security, efficiency; and transparency in the finance industry. As adoption and innovation continue to grow, we can expect to see significant advancements and opportunities in the future.

Conclusion

In conclusion, the future of finance looks promising with the advancements and potential of blockchain technology. As the technology continues to mature and adoption grows, we can expect to see significant improvements in efficiency, security, and transparency in the finance industry.

Related posts

https://asoservice.com/app-installs-downloads

https://asoservice.com/microsoft-store-app-reviews

Thanks so much for reading this article.

Source: https://asoservice.com/

Leave a Reply

Your e-mail address will not be published. Required fields are marked *